Whitepaper: Haycen & the future trade finance tech stack

Haycen lays out its vision of the future trade finance tech stack that can open the next chapter in global commerce.

Haycen digital payments & the future trade finance tech stack

Trade finance underpins approximately 80% of global trade, and is estimated to be a $5.2trn market (McKinsey). Within trade finance, subset products include commodity finance (CF), the provision of funding to facilitate the import and export of materials from seller to a buyer either internationally or domestically along a supply chain. CF is largely self-liquidating, short-term, cash flow-driven and asset- backed along a supply chain.

Successive regulatory changes have forced banks to scale back trade lending operations, by volume and risk appetite - Basel IV exacerbated the move by banks from buy-and-hold to originate-and distribute (World Economic Forum).

In fact bank lending is increasingly focused on higher credit rated companies for their existing clients where they have total visibility over their balance sheet.

This leaves lower credit rated businesses widely shut out from this vital bridge to liquidity.

In Haycen’s work, we have seen firsthand the growing impact digital payments can have in closing this liquidity gap so more businesses can access private market lending and accelerate their operations.

But how will the future tech stack for global trade evolve? And where does digital payment innovation fit into this evolution?

We lay out our vision for the future tech stack in global trade and 3 areas where Haycen underpins the next wave of innovation.

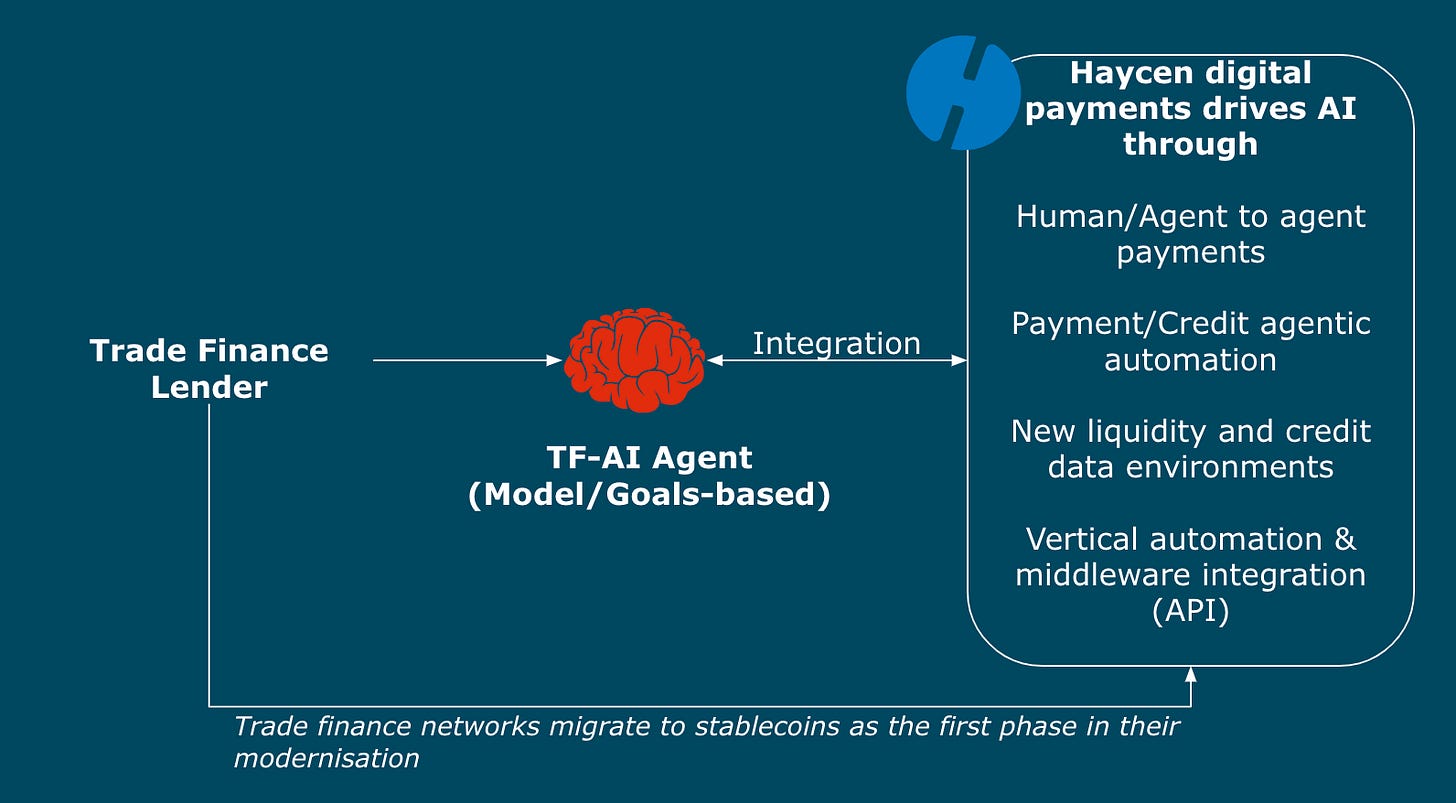

Trade Finance AI Agents, agentic automation driven by onchain payments, liquidity and credit underpin the new tech stack

1. The Foundation: Digital currency and onchain payment rails

Digital payments are the pathway to broader digitisation in the global trade industry.

B2B wholesale flows are structured very differently to retail flows. They are heavily orchestrated, tied to rules between multiple parties and subject to layers of authorisation. So whilst the underlying currency may be fungible and open, trade finance payment channels are typically closed loop to KYC’d counterparties.

Payment counterparties are also credit counterparties, lending itself to greater automation in how financing and payments are executed, because the more data that can be gathered the more accurate the financing arrangements can be made.

The reduction and in some cases elimination of correspondent banking through the digital payment (stablecoin) liquidity network increases control over cashflows globally, enabling both the immediacy of settlement and reduction in trapped liquidity.

And more fundamentally, Haycen’s new digital formats for the underlying currency and onchain payment rails synchronizes with new digital formats for documentation, legal services and supply chain management that are so important in modernisation of trade finance processes.

Over time, agents will interact with other agents to accomplish specific tasks as found in Mixture of Experts (MoE) agent models.

Why onchain payment rails

Transaction costs should be zero at all times for any amounts to any counterparty, globally. This can be done using Haycen digital payments.

Swift reports that 40% of wholesale payments still encounter delays at the beneficiary leg due to compliance functions, batch processing, and market-operating-hour limitations. Haycen reduces these delays.

Haycen increases access to major currencies at a lower deposit and transaction rate amongst exporting nations in Africa, Latin America, SE Asia and Eastern Europe. The more businesses that can access and hold major currencies the more wealth can be created and distributed.

2. Agentic Automation in Trade Finance

Once formats for money, contracts and authorisations have been synchronized into digital formats, new AI-enabled workflows will be able to call on advanced models to create and run complex workflows in global trade.

Such workflows will orchestrate the trade finance workflow cycle including payment automation that reduces the need for pre-payment deposits, a key settlement and credit risk when managing global trade.

These workflow models will eventually blur the distinction between fiat and digital currency (stablecoin) formats as it will choose the appropriate payment rails and method, meaning that new financial services need to offer hybrid FIAT/digital services. The AI workflow models will be able to choose to:

Use digital payments (stablecoins) as the underlying liquidity with fiat sent as payment

Convert fiat deposits, use the onchain payment rail to transact, and convert back to fiat to deposit with the counterparty

Generate yield returned in fiat or in digital

Hold a balance without the counterparty knowing what format the currency is held in

AI Workflows can pull and incorporate data from a digital payment payment regime that alters the ROI profile for trade finance in ways that traditional formats do not.

Yield from digital currency fundamentally alters cost of capital, moving this from a cost centre to an operational advantage.

Trapped liquidity diminishes as the need to hold large multi-currency deposits in local banks reduces

On large infrastructure projects the GVA (Gross Value Added) - a measure of economic value that a project adds to the local or regional economy - increases

Digital payments build and improve upon existing bank products such as “In House Banks” and centralised POBO/COBO capabilities that aim to offer a single currency account globally for large enterprises.

Digital workflows in trade finance will further develop the use of digital payments. Delays in the documentary chain slow the movement of goods and services globally. Solutions are now emerging that digitize bills of laden and letters of indemnity to enhance traceability and transparency. This dramatically time compresses the authorisation process. As these processes increase in speed, the corresponding settlement times for payments will also increase commensurate with what digital payments offer over and above FIAT rails.

Workflow automation can utilize digital payment payments not only to automate the conditions and timing of payments, but also extract data on the behaviour and efficiency of liquidity movements based on the specific trade financing conditions and markets they operate in.

Borrowers and SME’s can opt into these new digital payment based AI systems, broadening their access to new, cheaper forms of FX hedging and short term (12 months or under) financing, amongst others.

3. Into the Future: TF-AI, the Trade Finance AI Agent

Beyond automation and digital workflows lies TF-AI, the Trade Finance AI Agent.

New digital trade finance lenders will run TF-AI’s that lend autonomously and adapt to variables in deal structure, operational, legal and payment processing in order to optimize specific outcomes set by the business.

The lenders themselves may be organised as an onchain fund, utilizing new tokenized investment structures with onchain investment and dividend distribution mechanisms.

Model-based TF-AI’s can pursue complex supply chain lending based on internal models of previous scenarios, as TF-AI organises and orchestrates its borrowers, exporters and counterparties.

Goals-based reflex TF-AI’s can optimize returns for a particular market, commodity or supply chain segment. TF-AI’s are highly adaptable to changes in environments, ideal for large financing programs with multiple counterparties and often changing data inputs.

Lenders can build tailored relationships with their credit counterparties who will be treated individually with dynamic credit profiles to suit them. They can move from static to dynamic credit extension based upon better real time models TF-AI creates. Traditional fraud, waste and abuse models will be phased out as intermediaries are unable to influence and extract money flows for their benefit.

Borrowers and SME’s opt into new managed, blockchain-based accounts that include a built-in customer portal for facilitating the collection of payments and managing the credit accounts. Lenders run these AI Agents as part of a new financial services stack that combines payments, workflow automation and credit extension into a highly organised, centralised and efficient tech-enabled business.

The Future Financial Services model for Trade Finance

Haycen powers digital trade finance technology to reduce the cost of banking and processing complex global trade finance. But beyond that they provide a new alternative way to extend credit to more participants around the world in a safe and efficient manner. New financial services will also rely on:

New digital FX and FIAT on/off ramp services.

Credit data models, using a Haycen onchain liquidity network

Advancements in digital treasury and cash management capabilities, driven by new digital asset wallet and account structures

Lenders, borrowers and SME’s opting into - and increasingly transacting across - the onchain payment rail, relying less on local banking infrastructure over time.

For more information on Haycen’s growing digital payment, stablecoin work, please subscribe to the Haycen substrack blog channel.